Karachi-based Raqami Islamic Digital Bank, Pakistan’s first fully digital Shariah bank, has teamed up with fintech pioneer Haball to offer embedded, Islamic finance straight into SME supply chains. This collaboration aims to fill a critical liquidity gap for small businesses, without the hassles of traditional loans. Why This Matters SMEs account for roughly 40% of

Karachi-based Raqami Islamic Digital Bank, Pakistan’s first fully digital Shariah bank, has teamed up with fintech pioneer Haball to offer embedded, Islamic finance straight into SME supply chains. This collaboration aims to fill a critical liquidity gap for small businesses, without the hassles of traditional loans.

Why This Matters

SMEs account for roughly 40% of Pakistan’s GDP and employ the majority of the workforce, but over 90% struggle to access formal financing. Traditional banks often require asset pledges and lengthy paperwork, blocking many from support. The new platform changes that: payments are triggered by actual purchase orders or receivables, with no collateral required, fully built into routine business flows.

How It Works

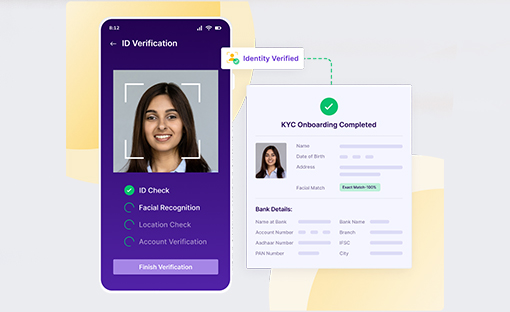

- Digital Onboarding & KYC: Clients can sign up for Murabaha-based financing entirely online, all under Shariah principles.

- Seamless Workflow Integration: The solution plugs straight into ERP systems, distributor networks, or anchor companies—sending money when orders are placed, not when paperwork is ready.

- Smart AI Underwriting: Instead of relying on traditional credit history, the platform assesses cash flow patterns and delivers near-instant decisions.

- Instant Disbursement & Monitoring: Funds hit accounts quickly, and both financiers and businesses can track transaction history in real time for full transparency.

The Big Impact

Umair Aijaz, CEO of Raqami, emphasized their mission to “reimagine Islamic banking through tech-led innovation.” This partnership brings Shariah-compliant financing “to the very heart of Pakistan’s supply chains,” he said, without requiring traditional guarantees.

From Haball’s side, CEO Omer Bin Ahsan described the move as enabling context-driven finance: embedding liquidity into daily transactions to “democratize capital access” and enhance visibility across supply chains.

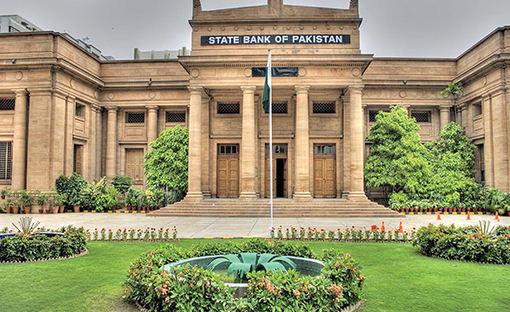

Backed by National Vision

This effort aligns neatly with the State Bank of Pakistan’s national agenda of expanding financial inclusion and digitizing financial services. The central bank’s roadmap highlights Shariah-compliant supply-chain finance as a pillar for sustainable, broad-based economic development.

By letting SMEs plug into financing directly through their work flows, the Raqami–Haball platform offers a powerful tool for small businesses, and a major upgrade to Pakistan’s fintech landscape.

Leave a Comment

Your email address will not be published. Required fields are marked with *