The State Bank of Pakistan (SBP) is poised to grant in-principle approvals to five newly established financial companies looking to launch digital banks in the country. This significant step towards expanding the digital banking landscape in Pakistan will see KT Bank, Mashreq Bank, Hugo Bank, Easypasisa and Raqami receive initial licenses. The SBP issued No-Objection

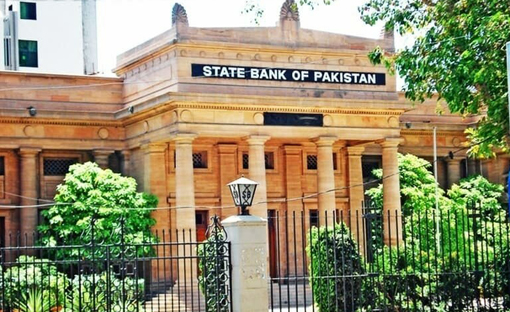

The State Bank of Pakistan (SBP) is poised to grant in-principle approvals to five newly established financial companies looking to launch digital banks in the country. This significant step towards expanding the digital banking landscape in Pakistan will see KT Bank, Mashreq Bank, Hugo Bank, Easypasisa and Raqami receive initial licenses.

The SBP issued No-Objection Certificates to these entities in January 2023, with clear directives to establish their corporate structures, including hiring staff within the country. After undergoing a rigorous assessment process covering various parameters such as financial strength, business plans, cybersecurity strategies, and more, these companies were selected for this initiative.

The central bank is expected to evaluate the financial soundness of the sponsors and subsequently award the initial licenses, with the anticipated date being around September 20.

Once these digital banking entities receive their in-principle approvals, they will have a year to streamline their operations before proceeding with pilot and commercial launches. Of the five, three will become full-fledged digital banks, while two will operate as digital retail banks.

This development is expected to attract substantial investments of around Rs. 50 billion from both local and foreign sponsors, which will be allocated towards paid-up capital, operational infrastructure, and human resources. The move towards digital banking represents a significant step forward for Pakistan’s financial industry, providing increased accessibility and convenience for customers across the country.

Leave a Comment

Your email address will not be published. Required fields are marked with *